Fashion market capitalization refers to the total value of a company or companies in the fashion industry, as determined by the stock market. It is calculated by multiplying the number of shares of a company's stock by its current market price. Fashion market capitalization provides a measure of the size and financial strength of the fashion industry, and it is an important factor for investors and stakeholders in determining the potential for growth and profitability.

The fashion market capitalization of a company can fluctuates greatly based on economic conditions, consumer demand, and other factors, making it an important indicator of the overall health of the fashion industry.

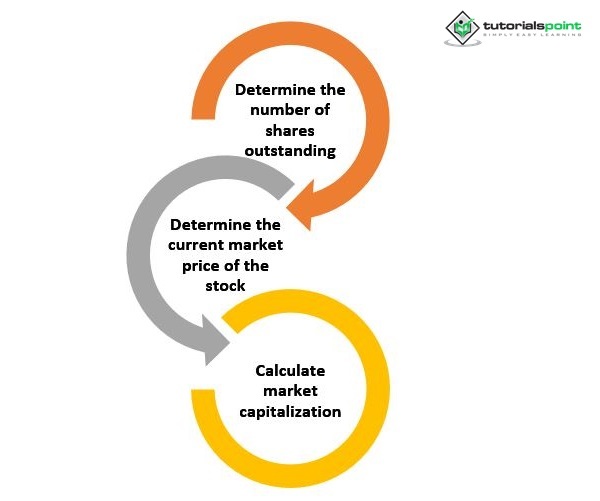

The process of calculating fashion market capitalization involves the following steps

Determine the number of shares outstanding − The number of shares of a company's stock that are owned by shareholders and available for trading is known as the "outstanding shares."

Determine the current market price of the stock − The current market price of a company's stock is determined by the current supply and demand for the stock in the stock market.

Calculate market capitalization − To calculate the market capitalization of a company, multiply the number of shares outstanding by the current market price of the stock

For example, if a company has 1 million shares outstanding and the current market price of each share is $20, the market capitalization of the company would be 1 million x $20 = $20 million.

It is important to note that fashion market capitalization is a dynamic number and can fluctuate greatly based on changes in the stock market and other economic factors.

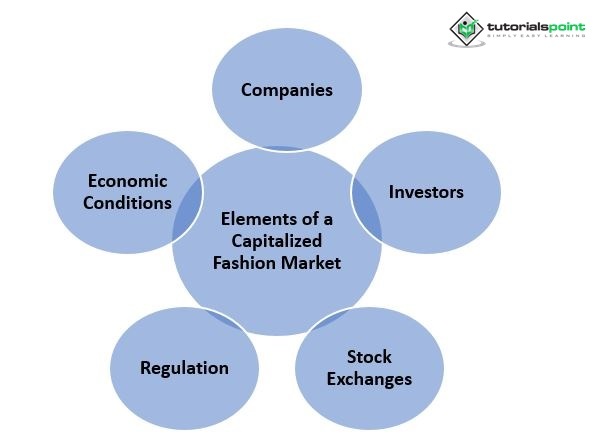

Elements of a capitalized fashion market

A capitalized fashion market consists of several key components

Companies − A capitalized fashion market is made up of publicly traded companies that are engaged in the fashion industry. These companies may include fashion designers, retailers, wholesalers, and manufacturers.

Investors − The capital markets are driven by the demand for investment capital. In a capitalized fashion market, investors may include individuals, institutional investors, and investment funds.

Stock exchanges − The stock exchanges where fashion companies are listed, such as the New York Stock Exchange (NYSE) or NASDAQ, play a crucial role in the capitalization of the fashion market.

Regulation − Capital markets are subject to regulations that are designed to ensure fair and transparent trading practices. This includes regulations regarding the issuance and trading of securities as well as the reporting requirements for publicly traded companies.

Economic conditions − The capitalization of the fashion market can be greatly impacted by the overall economic conditions, such as interest rates, inflation, and consumer spending patterns.

These elements work together to determine the size and financial strength of the capitalized fashion market and are an important factor for investors and stakeholders in determining the potential for growth and profitability.

The capitalized fashion market has several distinctive characteristics, including

Liquidity − The capitalized fashion market is characterized by a high degree of liquidity, as shares can be easily bought and sold on stock exchanges.

Publicly traded companies − Companies in the capitalized fashion market are publicly traded, meaning that anyone can invest in them and own a piece of the company.

Transparency − The capitalized fashion market is characterized by increased transparency, as publicly traded companies are required to disclose financial and operational information to the public.

Market-driven − The capitalized fashion market is driven by market forces, such as supply and demand, and is influenced by economic conditions, consumer preferences, and investment trends.

Competition − Companies in the capital-intensive fashion market compete for investment capital and consumer attention, which can lead to innovation and growth.

Regulated − Regulations govern the capitalized fashion market with the goal of ensuring fair and transparent trading practices, protecting investors, and promoting stability.

Overall, the capitalized fashion market is an important aspect of the fashion industry, offering investment opportunities and contributing to the growth and development of the sector.

The valuation of the capitalized fashion market is the process of determining the value of publicly traded fashion companies. This is done by assessing various factors, including the company's financial performance, market conditions, consumer preferences, and competition.

There are several methods used to value a capitalized fashion market, including discounted cash flow (DCF) analysis, comparative analysis, and earnings multiple analysis. In a DCF analysis, the future cash flows generated by a company are estimated and discounted to present value to determine the company's worth.

In a comparative analysis, the company being valued is compared to similar companies in the market, and their market capitalization or enterprise value is used as a reference. In an earnings multiple analysis, the company's earnings are multiplied by a valuation multiple to determine the company's value, or enterprise value. UE is used as a reference.

In an earnings multiple analysis, the company's earnings are multiplied by a valuation multiple to determine the company's value, or enterprise value. In an earnings multiple analysis, the company's earnings are multiplied by a valuation multiple to determine the company's value. This multiple is determined based on the company's financial performance, growth potential, and industry factors. Ultimately, the valuation of the capitalized fashion market is a complex process that requires a deep understanding of the fashion industry and market dynamics, as well as the financial performance of individual companies.

The methods used for valuing a capitalized fashion market include

Discounted Cash Flow (DCF) Analysis − This method estimates the future cash flows generated by a company and discounts them to present value to determine the company's worth.

Comparative Analysis − This method compares the company being valued to similar companies in the market and uses their market capitalization or enterprise value as a reference.

Earnings Multiple Analysis − This method multiplies the company's earnings by a valuation multiple to determine the value of the company. The multiple is determined based on the company's financial performance, growth potential, and industry factors.

Market Capitalization Analysis − This method calculates the market value of a company by multiplying its current stock price by the number of outstanding shares.

Revenue Multiple Analysis − This method multiplies the company's revenues by a valuation multiple to determine its value. The multiple is determined based on industry factors and the company's financial performance.

Asset-Based Analysis − This method values a company based on its assets, including property, plants, and equipment, inventory, and investments.

Each of these methods has its own strengths and limitations, and the choice of method depends on the specific characteristics of the company being valued and the overall state of the fashion market.

In conclusion, the fashion market capitalization is an important aspect of the fashion industry, providing insights into the value of fashion companies and their growth potential. There are various methods for valuing a capitalized fashion market, each with its own advantages and disadvantages. The choice of method depends on the company's specific characteristics, industry factors, and the state of the fashion market. A well-capitalized fashion market provides opportunities for investment and growth and can help drive innovation and development in the industry.